Bitcoin’s (BTC) price is at a crucial make-or-break point as the market anticipates Wednesday’s Federal Open Market Committee (FOMC) meeting. However, expectations for the event are no longer evenly split, despite being so just two days ago.

If the meeting results in a lower basis point (bps) adjustment, historical trends suggest that BTC’s price may undergo a significant correction. A higher rate cut delivered by the Fed, led by Chair Jerome Powell, should boost Bitcoin’s price. This on-chain analysis explains why any potential gains in the latter scenario may be short-lived.

Bitcoin Whales Sell the News

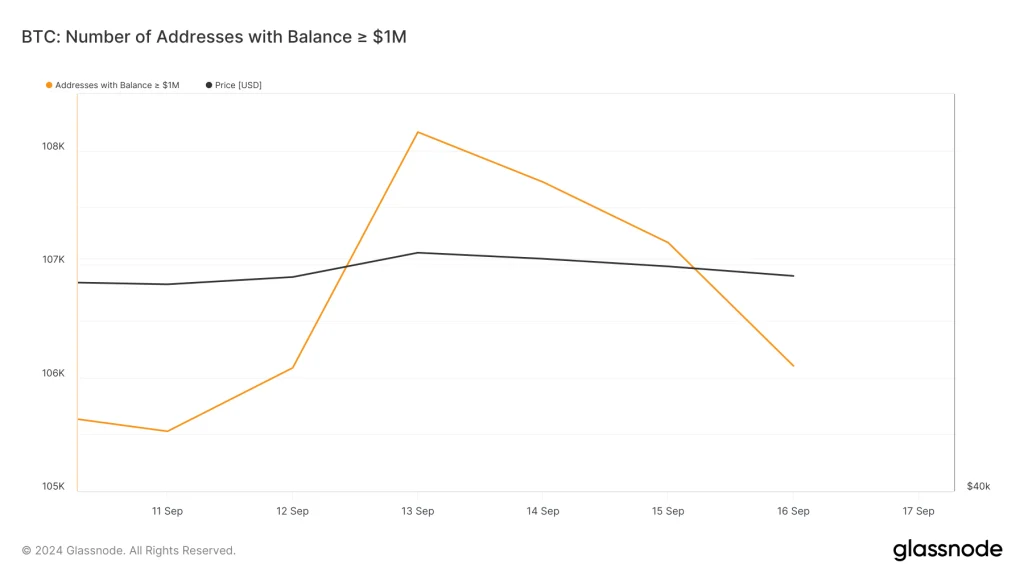

Data from Glassnode shows that Bitcoin whales are selling off ahead of the highly anticipated FOMC meeting. For instance, on September 13, the number of addresses holding over $1 million worth of BTC was 108,163.

Today, Bitcoin’s whale holdings have dropped to 106,104 BTC, signaling a sell-off of over 2,059 BTC valued at more than $2 billion. This “sell the news” behavior reflects growing caution among large holders, who may be preparing for potential volatility as the market awaits clues on future monetary policy.

For instance, Lookonchain reported that a whale sold 500 BTC on Monday. A day before that, another Bitcoin whale deposited 119 BTC to Binance. This massive sell-off suggests that whales are positioning themselves defensively, anticipating possible short-term turbulence before, amid, and after the meeting.

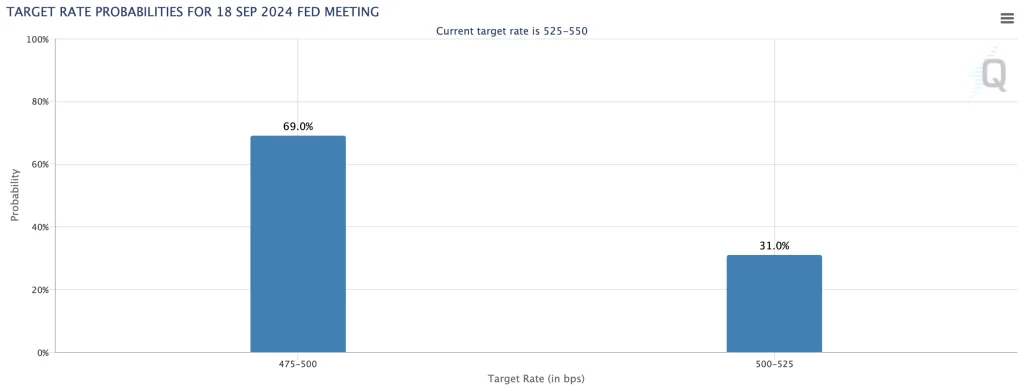

According to the CME FedWatch tool, the chance of 50 bps is 69%, while that of 25 bps is 31%. For context, the tool measures the likelihood of an interest rate cut.

In August, Fed Chair Powell hinted at a rate cut during the Jackson Hole Speech. The statement at that time gave Bitcoin’s price a brief push above $62,000. Over the weekend, the cryptocurrency jumped to $60,000 but currently trades below that region.

Likely Rate Cut Could Offer Unsustainable Boost

While the broader market might be bracing up for a rebound due to the above-highlighted probability, some analysts believe the aftereffect might not be sustainable.

One of those with such sentiment is Markus Theilien, head of research at 10xResearch. In a report dated September 16, the firm noted that a 50 bps is very likely to be the outcome of the FOMC meeting. However, the report also stated that Bitcoin may not see the significant price boost many market participants are anticipating.

“The Federal Reserve should consider a 50 basis point rate cut, but whatever action it takes this week might not provide the significant liquidity boost many hope for. Historically, Bitcoin’s performance following rate cuts has been mixed; for example, after the 2019 rate cut, Bitcoin’s initial gains were short-lived, and the price dropped by 30% a few months later,” Thielen emphasized.

Final Thoughts

The anticipation surrounding the upcoming Federal Open Market Committee (FOMC) meeting is creating significant uncertainty for Bitcoin’s price, as investors weigh the impact of a potential interest rate cut. While some market participants expect a boost to BTC if the Federal Reserve opts for a higher rate cut, historical data suggests that such gains may be short-lived.

The recent sell-off by Bitcoin whales, as indicated by on-chain analysis, reflects growing caution, signaling that large holders are preparing for potential volatility regardless of the outcome. This defensive positioning underscores the fragile nature of any potential price surge.

Moreover, while the possibility of a 50 bps rate cut might spark optimism for short-term price increases, analysts like Markus Theilien caution that this may not provide the liquidity boost many are hoping for.

Past rate cuts, such as the one in 2019, led to brief rallies followed by significant declines, suggesting that any post-FOMC surge could be temporary. As the market braces for turbulence, Bitcoin’s longer-term trajectory will likely depend on broader economic conditions and how investors react to changing monetary policies.

Article Source: Beincrypto