The hacker responsible for the WazirX security breach has moved over $23 million worth of stolen Ethereum (ETH) in the past 24 hours. This comes amidst the exchange’s restructuring efforts which could see 55-57% of the stolen assets being returned to users.

Funds Likely Heading to Tornado Cash

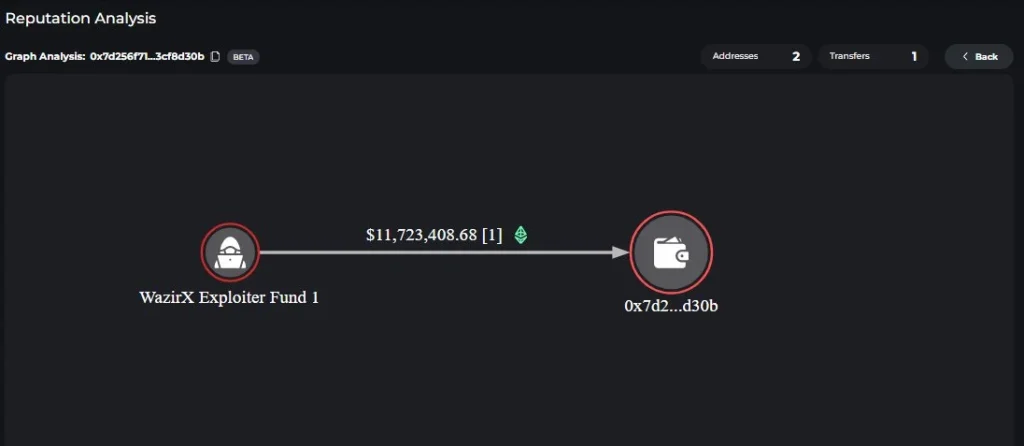

According to Cyvers Alerts, the hacker transferred 5,000 ETH, valued at approximately $11.7 million, to a new address on September 10. This transaction follows a similar one on September 9, where another 5,000 ETH, worth $11.5 million, was moved to a different address.

This brings the total funds moved by the exploiter in the last 24 hours to around $23 million. Both transactions are also believed to be headed to Tornado Cash, a sanctioned service that allows users to mask wallet addresses on various blockchains.

The attacker started moving funds through the crypto mixer on September 3. Although not legal in the U.S., the mixer is often used by crypto criminals to obscure the trail of stolen assets.

According to data from Arkham, this move follows the hacker’s recent transfer of approximately $4 million worth of ETH on the Ethereum network to the crypto mixer. The associated address holds over $109 million in various tokens, with $103 million in ETH.

Recovery Efforts

This series of transactions follow the security breach in July, where WazirX’s multisig wallet was compromised, resulting in the theft of over $230 million in user assets.

Since the incident, the exchange has announced that affected customers will not be able to recover their full funds. The firm is currently undergoing restructuring, with the possibility of returning 55-57% of the stolen assets to users.

“This is what can be returned to users with the benefit of this restructuring,” said Jason Kardachi, managing director (restructuring) at Kroll, during a virtual press conference.

The effort includes developing revenue-generating products and mechanisms to share profits with users, tracing and recovering stolen crypto assets, and enabling those who need immediate liquidity to withdraw their assets more swiftly and exit the restructuring process.

According to the company, those who remain during the process are expected to receive higher recoveries.

WazirX is also actively searching for a “white knight” investor to inject capital and explore potential partnerships and collaborations. Additionally, the company intends to distribute the remaining assets to users on a pro-rata basis.

Final Thoughts

The movement of over $23 million in stolen Ethereum by the hacker responsible for the WazirX breach highlights the ongoing challenge of securing digital assets on crypto exchanges. The use of Tornado Cash, a notorious crypto mixer, to obscure the stolen funds complicates efforts to trace and recover the assets.

This demonstrates the persistent vulnerabilities in the crypto ecosystem, where even sanctioned services can be exploited by criminals to launder significant sums of money. Despite the sanctions against Tornado Cash, its continued use by hackers raises questions about how well regulatory measures can prevent such activities.

On the other hand, WazirX’s efforts to restructure and partially compensate users reflect the difficult path exchanges face after major security breaches. The plan to return 55-57% of the stolen assets, while far from full restitution, shows the platform’s commitment to managing the fallout responsibly.

The search for a “white knight” investor and the development of new revenue streams indicate WazirX’s proactive approach to rebuilding trust and maintaining operations. However, the scale of the breach and the incomplete recovery of funds are a stark reminder to users and platforms alike about the importance of enhancing security measures in the crypto space.

Article Source: CryptoPotato