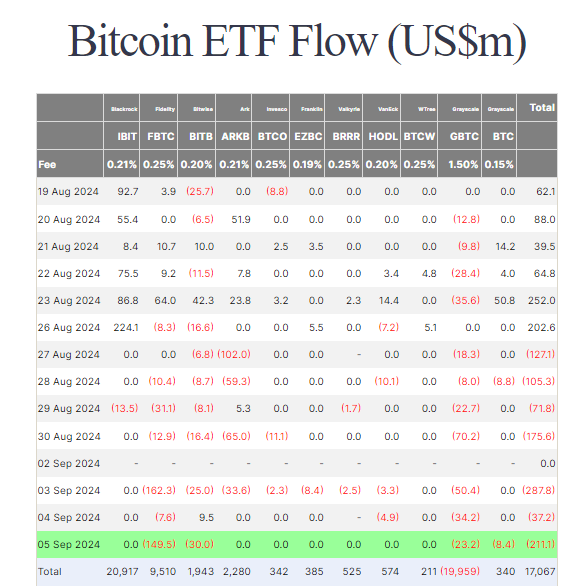

Recent data from Farside reveals significant outflows from Bitcoin ETFs on Sept. 5, totaling $211.1 million. This marks the seventh consecutive trading day of outflows, with no ETF issuers reporting any inflows on Sept. 5. Four major issuers experienced notable outflows: Fidelity’s FBTC saw the largest drop with $149.5 million, followed by Bitwise’s BITB with $30.0 million, Grayscale’s GBTC with $23.2 million, and BTC ETFs with $8.4 million.

Since Aug. 27, over $1 billion has exited BTC ETFs, bringing total net flows to $17.1 billion. During this period, Bitcoin’s price has dropped from approximately $62,000 to $55,500.

Ethereum ETFs have seen significantly less activity. There was a modest $0.2 million outflow, with most movement concentrated around Grayscale’s products. Grayscale’s ETHE saw a $7.4 million outflow, while ETH ETFs recorded a $7.2 million inflow. Despite these changes, total outflows for Ethereum ETFs have now reached $562.5 million, according to Farside data, and the price of Ethereum is now negative for the year.

Final Thoughts

The significant outflows from Bitcoin ETFs, totaling $211.1 million on September 5, underscore growing investor apprehension in the crypto market. Over the past seven days, more than $1 billion has been withdrawn from these funds, reflecting a broader trend of uncertainty, especially as Bitcoin’s price has declined sharply from $62,000 to $55,500. This prolonged exit from Bitcoin ETFs suggests a lack of confidence among institutional investors, which could further exacerbate downward pressure on the cryptocurrency’s value.

In contrast, Ethereum ETFs have seen comparatively minor movements, with a net outflow of $0.2 million on the same day. While Grayscale’s Ethereum products experienced some outflows, there was still a modest inflow into other ETH ETFs. Despite these mixed signals, Ethereum’s price remains negative for the year, and cumulative outflows have reached $562.5 million. This divergence in market activity between Bitcoin and Ethereum ETFs highlights the varied investor sentiment and market dynamics, as Ethereum appears to be holding relatively steady in a volatile landscape.

Article Source: CryptoSlate